All Categories

Featured

If you're going to make use of a small-cap index like the Russell 2000, you could want to pause and think about why a good index fund firm, like Vanguard, does not have any kind of funds that follow it. The factor is since it's a poor index.

I haven't even addressed the straw guy here yet, and that is the fact that it is reasonably unusual that you actually have to pay either tax obligations or significant commissions to rebalance anyway. Most smart financiers rebalance as much as possible in their tax-protected accounts.

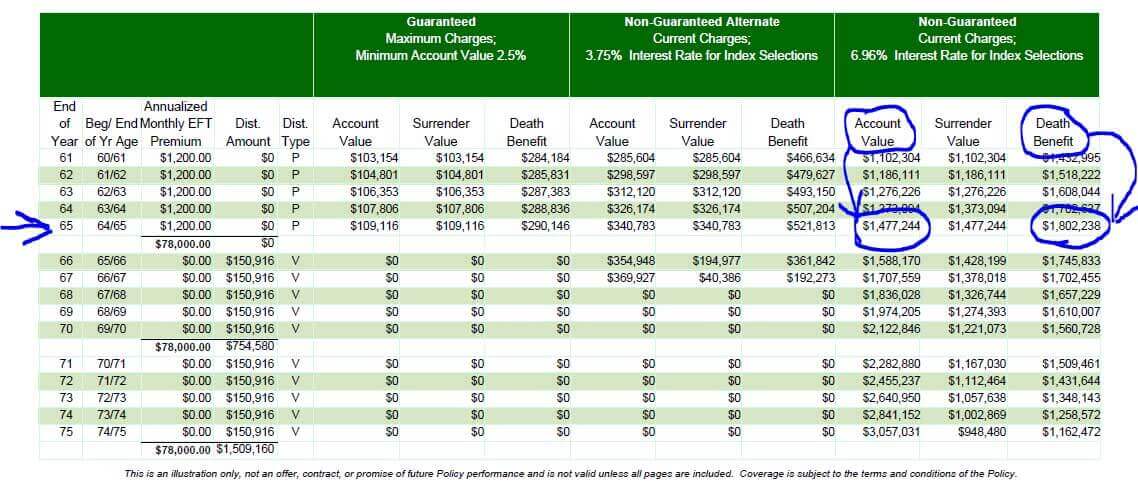

Guaranteed Universal Life Insurance Rates

Decumulators can do it by taking out from property courses that have done well. And obviously, nobody ought to be getting packed mutual funds, ever before. Well, I hope posts like these help you to see through the sales tactics frequently used by "economic specialists." It's truly as well poor that IULs don't function.

Latest Posts

Index Linked Term Insurance

Fixed Universal Life

Max Funded Life Insurance